Inflation Adjusted Crude Oil Prices Chart:

"Are Oil Companies Ripping us off with Gas Prices?

October 17, 2005

by Tim McMahon

Recently Gas at the pump has jumped almost exponentially while crude oil prices have stabilized and even have fallen a bit giving rise to the question... are they really correlated?

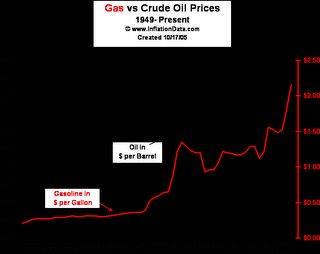

The chart to the right shows the correlation between the average annual price of gasoline and the average annual price of crude oil. By using the average annual price we eliminate brief spikes and get a better picture of what we really pay over the long term. If we see a brief spike many of us will put off buying gas as long as possible hoping to miss the spike so over the long term we will pay closer to the average price.

But as we can see from the chart gas and oil prices are fairly closely related. They tend to rise and fall in tandem but at some extremes oil will rise faster while at others gas seems to rise faster.

There is a simple explanation for this. Typically the oil price remained below the gas price with the major exception being during the price spike in 1979 -80. If you will notice it also appears that Oil prices are more volatile and erratic while gas prices don't fluctuate quite as much.

Over the last 10 years even though oil prices fell lower and lower gas prices remained the same. Why? Is it some collusion by the oil companies? No actually it is much less sinister than that. It is actually just supply and demand. Over the last almost 30 years (since 1976) there have been no new refineries built in the US due to tight regulations, environmental restrictions combined with low prices making the oil business less profitable. So supply has gotten tighter and tighter with it culminating recently with only one or two percent excess capacity at the refineries.

When supply gets that tight several things happen, first of all, it goes from being a buyer's market to a seller's market and secondly any slight disruption causes all kinds of havoc. And that is exactly what has happened every time a minor storm shut down a refinery for a day we would see a new spike in gas prices at the pump. But then along came hurricane Katrina and it has shut down a dozen refineries for as much as six weeks. Reducing supply by as much as one fifth. In some cases not because of problems at the refineries but also because of transportation issues.

So the recent spikes are due primarily to a lack of processing capacity. And unfortunately, it won't be fixed soon yes the shut down refineries will come back on line but what we really need are more refineries and that takes time. You can build a new refinery over night. Plus there is all the 'red tape' to get regulatory approval and no one wants a refinery in their back yard.

These issues need to be addressed but my guess is that with higher prices at the pump the oil companies will be more motivated to build new refineries and somehow it will get done. But in the mean time we need to learn to conserve gas."

Comments